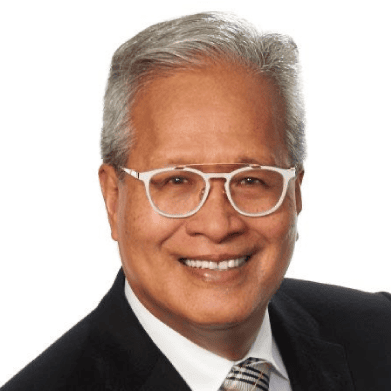

Lisa Patel is a visionary leader, award-winning real estate professional, entrepreneur, and speaker who has left an indelible mark on the Greater Toronto Area and beyond. With over 16 years of experience in real estate and a lifetime immersed in entrepreneurial ventures, Lisa is driven by a passion for building communities, empowering individuals, and fostering meaningful connections.

A Legacy of Leadership and Innovation Lisa Patel’s journey is deeply rooted in entrepreneurship. Growing up in a family of business owners who operated motels, hotels, retail stores, and restaurants across Ontario, Lisa’s entrepreneurial spirit was evident from a young age. Her first ventures included selling gift-wrap and bubble gum to classmates and running a candy shop, foreshadowing her future success as a business leader.

Today, Lisa leads the Property Princess Group, a dynamic group of real estate professionals specializing in residential, commercial, leasing, land, and investment properties across the GTA. Under Lisa’s leadership, the team is known for its integrity, innovation, and client-first approach. The Property Princess brand, synonymous with excellence in real estate, has been featured in McGraw-Hill educational materials and celebrated for its brand strength and consistency by author Andris Pone.

A Respected Voice in Real Estate and Beyond Lisa’s influence extends beyond real estate. As the former President of the Toronto Regional Real Estate Board (TRREB) — the largest real estate board in Canada and the world — Lisa has been a trailblazer in organized real estate, advocating for positive change and industry advancement. Her decade-long commitment to volunteer leadership with TRREB, the Ontario Real Estate Association (OREA), and the Canadian Real Estate Association (CREA) underscores her dedication to supporting realtors and enhancing the profession.

Her expertise in branding, leadership, and human connections has made her a sought-after speaker. Lisa has delivered talks at prominent organizations and events, including the University of Toronto’s Women in Business group, Speakers Slam, Royal LePage Signature, The Buzz Conference, WXN Women’s Executive Network, CIBC, Home Depot Canada, and more. She shares her insights on topics such as entrepreneurship, diversity and inclusion, transformation, and leadership.

A Champion for Community and Entrepreneurship Lisa’s commitment to giving back is at the core of her personal and professional life. Her mission is to create opportunities and shape our world for generations to come. She is also a huge advocate for community and community initiatives, both inside and outside the real estate space.

She has been a dedicated mentor with Futurpreneur Canada for nearly 15 years, guiding aspiring entrepreneurs to achieve their business goals. Her mentorship extends to the University of Information and Technology, where she supports young leaders in navigating their career paths. Lisa has also served as a Past Director of the Board of Trade and continues to volunteer with numerous community organizations.

Lisa’s community involvement goes beyond mentorship. She has been a passionate advocate for green initiatives, hosting the television show “A Greener Durham” on Rogers TV, which showcased environmentally conscious practices and resources available in the Durham region. Her dedication to sustainability and social responsibility remains a driving force in her work.

An Advocate for Lifelong Learning and Personal Growth Lisa is a firm believer in continuous learning and personal development. Her educational background spans Public Administration and Government, Public Relations, Project Management, Finance, Marketing and Communications, Leadership, Life Coaching, Metaphysical Teachings, and Adult Education. She leverages this diverse knowledge to provide exceptional service to her clients, inspire her community, and support her mentees.

Looking Ahead As Lisa Patel steps into 2025, her mission remains clear: to continue building a legacy of empowerment, connection, and innovation. She is dedicated to fostering growth and enhancing opportunities in the real estate sector, supporting entrepreneurs, and creating lasting positive impacts within the communities she serves.

Lisa’s vision for the future further solidifying her role as a trusted voice in business and leadership. Her relentless drive to uplift others ensures that her influence will continue to grow, making a meaningful difference in the lives of those she touches.

With a unique blend of business acumen, community focus, and a deep understanding of human connection, Lisa Patel remains a trailblazer in her field — a leader who is shaping the future, one relationship at a time.